Paychex Payroll Calculator 2025 Calendar – How Is Your Paycheck’s Income Tax Withholding Calculated and number of dependents—will help your employer calculate the proper withholding. Completing your W-4 form correctly can protect . Running payroll for your small business is easier with the right tool on your side. In the search for that tool, you might come across ADP and Paychex. Both companies offer top-rated payroll tools .

Paychex Payroll Calculator 2025 Calendar

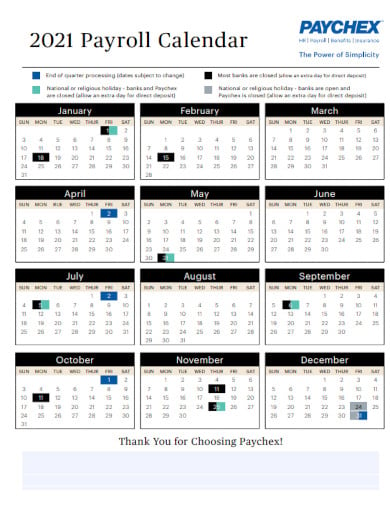

Source : www.hourly.io2023/2024 Payroll Calendar: How Many Pay Periods Are There? | Paychex

Source : www.paychex.comPayroll Calendar Template 13+ Free Excel, PDF Document Downloads

Source : www.template.net2023 Year End Payroll & Tax Checklist | Paychex

Source : www.paychex.com2023 and 2024 Biweekly Payroll Calendar Templates Hourly, Inc.

Source : www.hourly.ioWork Opportunity Tax Credit (WOTC) Explained | Paychex

Source : www.paychex.comPayroll Calendar Template 13+ Free Excel, PDF Document Downloads

Source : www.template.netOnline Business Calculators Taxes, Tip Credits, Expenses & More

Source : www.paychex.comCPA Voice July/August 2023 by CPA Voice Issuu

Source : issuu.comHow Many Pay Periods in a Year? 2024 Payroll Calendar Chime

Source : www.chime.comPaychex Payroll Calculator 2025 Calendar 2023 and 2024 Biweekly Payroll Calendar Templates Hourly, Inc.: With a few taps or clicks, the Military.com Military Pay Calculator can help you easily it may not be a part of your final paycheck if you are deployed or on a training rotation away from . Although it covers the entire calendar year payment (whichever is earlier) 15% Payroll taxes are deducted from every paycheck, taking a portion of the employee’s earnings. It is up to the employer .

]]>